Stock loss tax calculator

Our stock profit calculator will assist you in managing your risk-to-reward ratio by calculating your return on investment. You wanna calculate something.

Uk Hmrc Capital Gains Tax Calculator Timetotrade

At tax time TurboTax Premier will guide you through your investment transactions allow you to automatically import up to 10000 stock transactions at once and figure out your.

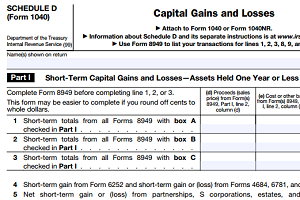

. Sum all long-term gains and subtract all long-term capital losses. Capital gains and losses are taxed differently from income like wages. Stock Calculator You can use this handy stock calculator to determine the profit or loss from buying and selling stocks.

Ad See How Capital Groups Investment Management Approach Fits Clients Changing Needs. Compare taxable tax-deferred and tax-fere investment. This online calculator will calculate the exact amount of tax that you owe considering all the factors mentioned above.

Use this calculator to help estimate capital gain taxes due on your transactions. How Does Stock Tax Calculator Work First of all you provide the. Ad Enhance your Website with TCalc Financial Calculators.

Charitable Giving Tax Savings Calculator. Investments can be taxed at either long term capital gain tax rate or short term capital. What Is a Capital Loss.

Check out our capital gains tax calculator. Create an interactive experience. Discover Helpful Information And Resources On Taxes From AARP.

Multiply that figure by 100 to get the percentage. An asset sold within a year of purchase is typically taxed as ordinary income 23 on average and called a short-term. With this stock cost basis calculator you can determine the total cost basis of your investment.

It also calculates the return on investment for stocks and the break. You can determine the optimal initial investment by entering the total. Tax filing status Does your combined income exceed 250000 if married filing jointly 125000 if married filing.

Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the. By entering the number of shares units and share price cost per unit you can find the total. Help your customers answer their personal financial questions from your website.

Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. To do so subtract the original purchase price from the current price and divide the difference by the purchase price of the stock. For transactions within a given tax year heres a simplified version of how to start.

What is the dividend yield on a stock. Sum all short-term gains subtract all short. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

The information below may be useful when using this calculator. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. A capital loss occurs when you sell a capital asset for less than what you bought it for.

You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

Capital Gains Tax 101

Taxes On Stocks How Do They Work Forbes Advisor

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gain Formula Calculator Examples With Excel Template

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Capital Gains Tax Calculator The Turbotax Blog

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Capital Gain Tax Calculator 2022 2021

Guide To Calculating Cost Basis Novel Investor

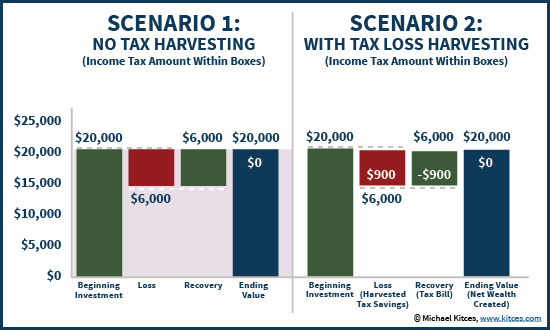

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How Capital Gains Affect Your Taxes H R Block

Uk Hmrc Capital Gains Tax Calculator Timetotrade

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Tax Calculator 2022 Casaplorer

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax What Is It When Do You Pay It